Gabo Esquivel - Enterprise & Institutional Engineering Experience

My journey into institutional engineering began with a realization that some of the most impactful technology work happens within established organizations that touch millions of lives daily. While the startup world often captures more attention, I've been drawn to the unique challenges of bringing innovation to enterprises operating under complex constraints. I still remember my first day at American Express, walking through their data center and grasping the scale of systems that processed millions of transactions daily—understanding that even small improvements could create enormous real-world impact. Throughout my career working with financial institutions, professional services firms, and major corporations, I've approached enterprise engineering as a balance of transformation and stability—introducing innovation while respecting the regulatory, security, and operational realities that these organizations face. This perspective reflects my belief that meaningful technological change in established institutions requires both technical expertise and an understanding of organizational context—combining "what could be" with "what must be" to create solutions that drive genuine progress.

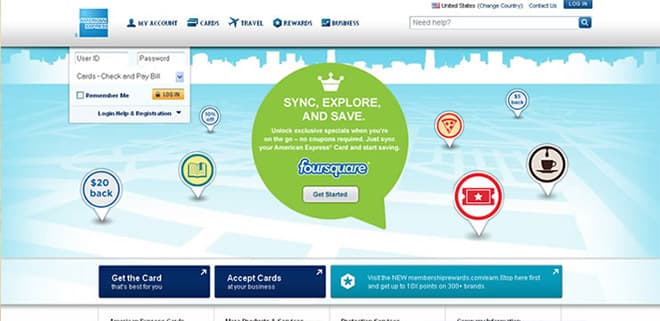

American Express: Financial Services Technology

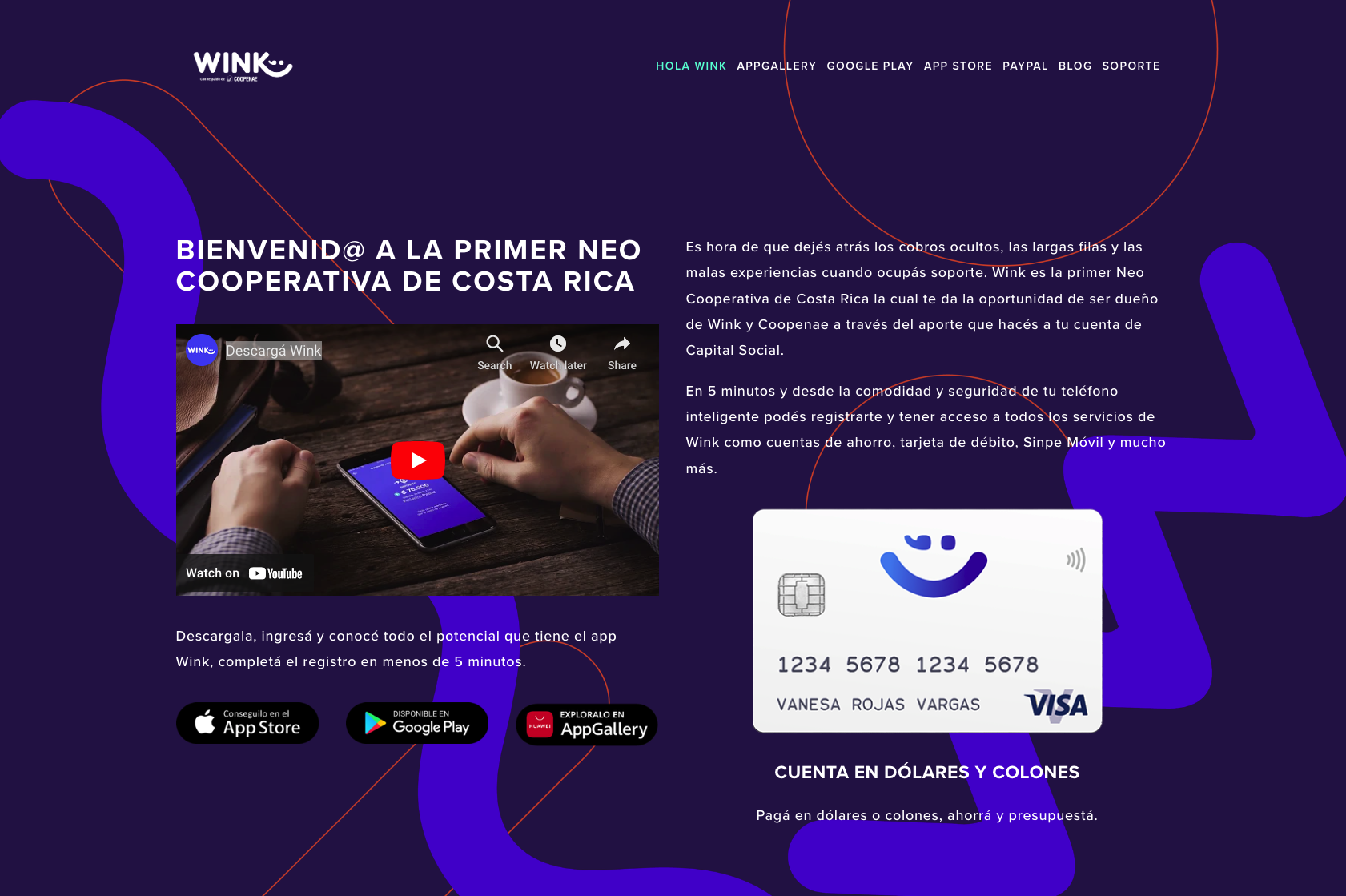

My first institutional experience came at American Express (2009-2012), where I joined as a UI Engineer focused on their credit card platforms. This environment introduced me to the unique demands of enterprise-scale financial technology—systems used by millions of cardmembers worldwide where even minor interface improvements could significantly impact how people managed their finances. I recall the weight of responsibility when releasing my first major update to the account interface, knowing that any confusion could result in thousands of customer service calls. This experience taught me the importance of thorough testing and meticulous deployment processes—practices that would become foundational to my approach in all future institutional work.

Beyond purely technical implementation, my work at American Express gave me insight into how large financial organizations evaluate and implement change. Collaborating with their data analytics teams showed me how A/B testing could transform interface design from subjective opinions to measurable outcomes, creating a framework for data-driven decision making that I would carry throughout my career. I also contributed to the National Money Night Talk campaign, developing a landing page focused on financial literacy—my first exposure to how institutional engineering can serve broader social goals beyond immediate product features. These experiences shaped my understanding of how technology operates within the complex ecosystem of a global financial institution, where innovation must coexist with stability, security, and regulatory compliance.

AMC Networks: Media & Entertainment Systems

At AMC Networks (2012-2014), I faced a different kind of institutional challenge—bringing digital innovation to an established media company navigating the early stages of streaming transformation. As the frontend team lead for YEAH! TV, launched at SXSW 2013, I needed to bridge creative vision with technical feasibility while working within corporate brand guidelines and content requirements. This project revealed the unique tension in media organizations between creative ambition and technical constraints—I remember lengthy discussions with film curators who wanted interactive features that pushed beyond what our technology could reliably deliver at scale.

The solution required both technical innovation and organizational adaptation. I implemented back-office systems with Brightcove integration and developed a video player with interactive capabilities, creating a platform optimized for curated films with 400+ interactive elements each. What made this project particularly valuable was learning to manage the complex stakeholder environment of a major media company—balancing the needs of creative teams, technical staff, business strategists, and executives with different priorities and perspectives. This experience broadened my understanding of institutional engineering beyond purely technical implementation, showing how successful enterprise technology requires navigating organizational dynamics as much as solving technical problems.

Coopenae Bank: Digital Transformation

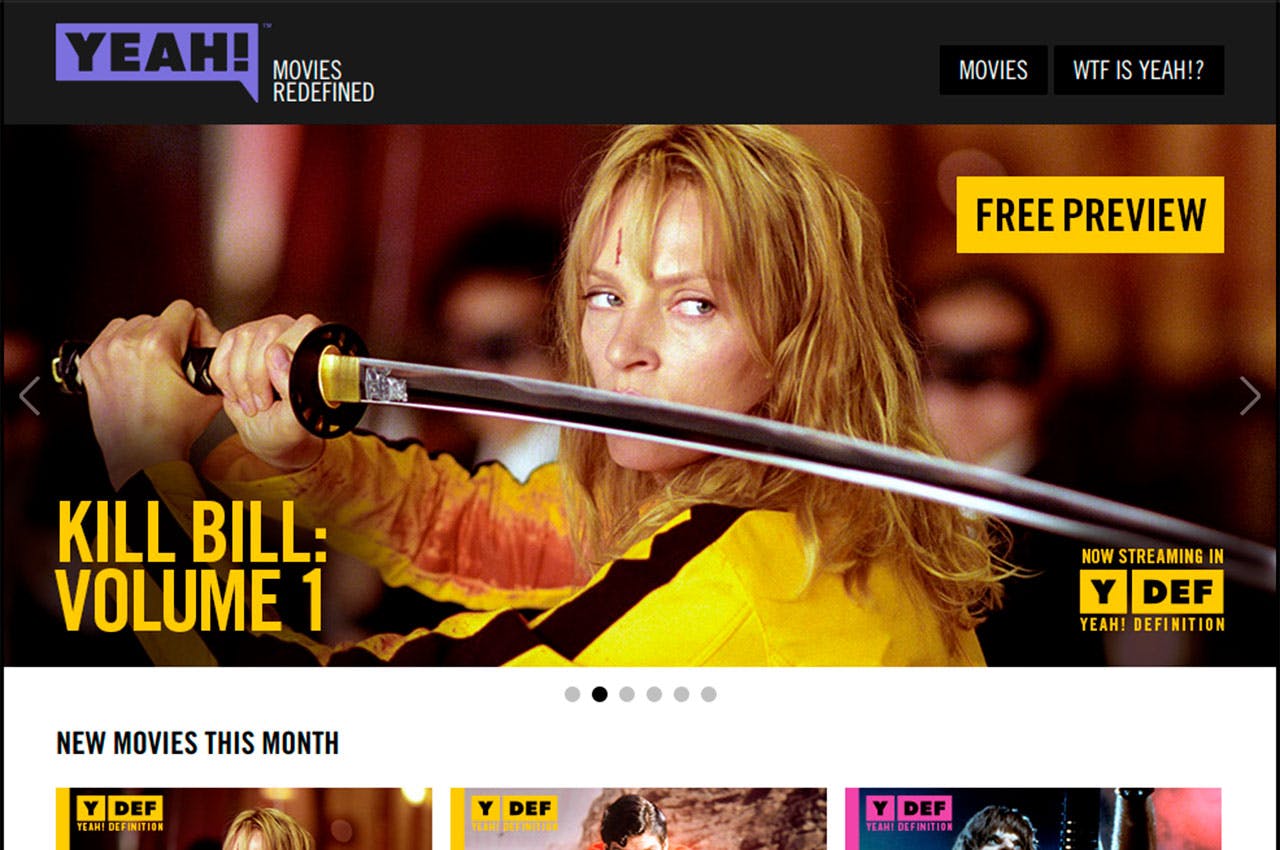

In 2015, I faced perhaps my most complex institutional challenge as Software Architect for Wink, Costa Rica's first digital banking platform, developed in partnership with Coopenae, one of the country's largest cooperative banks. This project required navigating the intersection of emerging fintech capabilities and traditional banking regulations—creating a mobile-first experience that could satisfy both customer expectations for modern interfaces and regulatory requirements for security and compliance. I recall the pivotal moment when presenting our biometric verification approach to banking regulators, carefully explaining how our solution could satisfy both security standards and usability requirements that initially seemed at odds.

The technical implementation included developing secure integrations with core banking systems, implementing biometric verification for KYC compliance, and creating transaction workflows that balanced security with usability. Beyond technical architecture, I needed to collaborate extensively with banking stakeholders, regulatory compliance officers, and security teams—translating between technical possibilities and institutional requirements. This project taught me how digital transformation in regulated industries requires patience and persistence, as innovation must progress at a pace that allows for proper risk assessment and compliance verification. The resulting platform allowed Coopenae to offer a modern banking experience while maintaining the security and reliability expected of an established financial institution, demonstrating how thoughtful engineering can bridge traditional institutional values with contemporary user expectations.

Grant Thornton: Enterprise Blockchain Solutions

From 2018 to 2020 at EOS Costa Rica, I had the opportunity to design and implement a custom private blockchain solution for Grant Thornton, one of the world's largest professional services networks. This project represented a fascinating intersection of emerging technology and institutional requirements—exploring how blockchain could address specific pain points in corporate financial processes while satisfying the rigorous security, privacy, and compliance standards of a Big Four accounting firm. As main architect and tech lead, I designed a system using Azure, Terraform, EOSIO, and a React client that streamlined intercompany transactions and tax management using stablecoins with immutable audit trails via IPFS.

What made this project particularly challenging was introducing a relatively new technology like blockchain into a conservative institutional environment with strict risk management protocols. I remember detailed discussions with partners and security officers, explaining blockchain concepts and addressing concerns about data privacy, transaction finality, and regulatory compliance. The process required translating complex financial requirements into technical specifications while ensuring enterprise-grade security—recruiting and building a development team specifically equipped to navigate these constraints. This experience demonstrated how even the most innovative technologies can find valuable applications within traditional institutions when implemented with careful attention to organizational context and compliance requirements.

Tractor Supply: Retail Technology Innovation

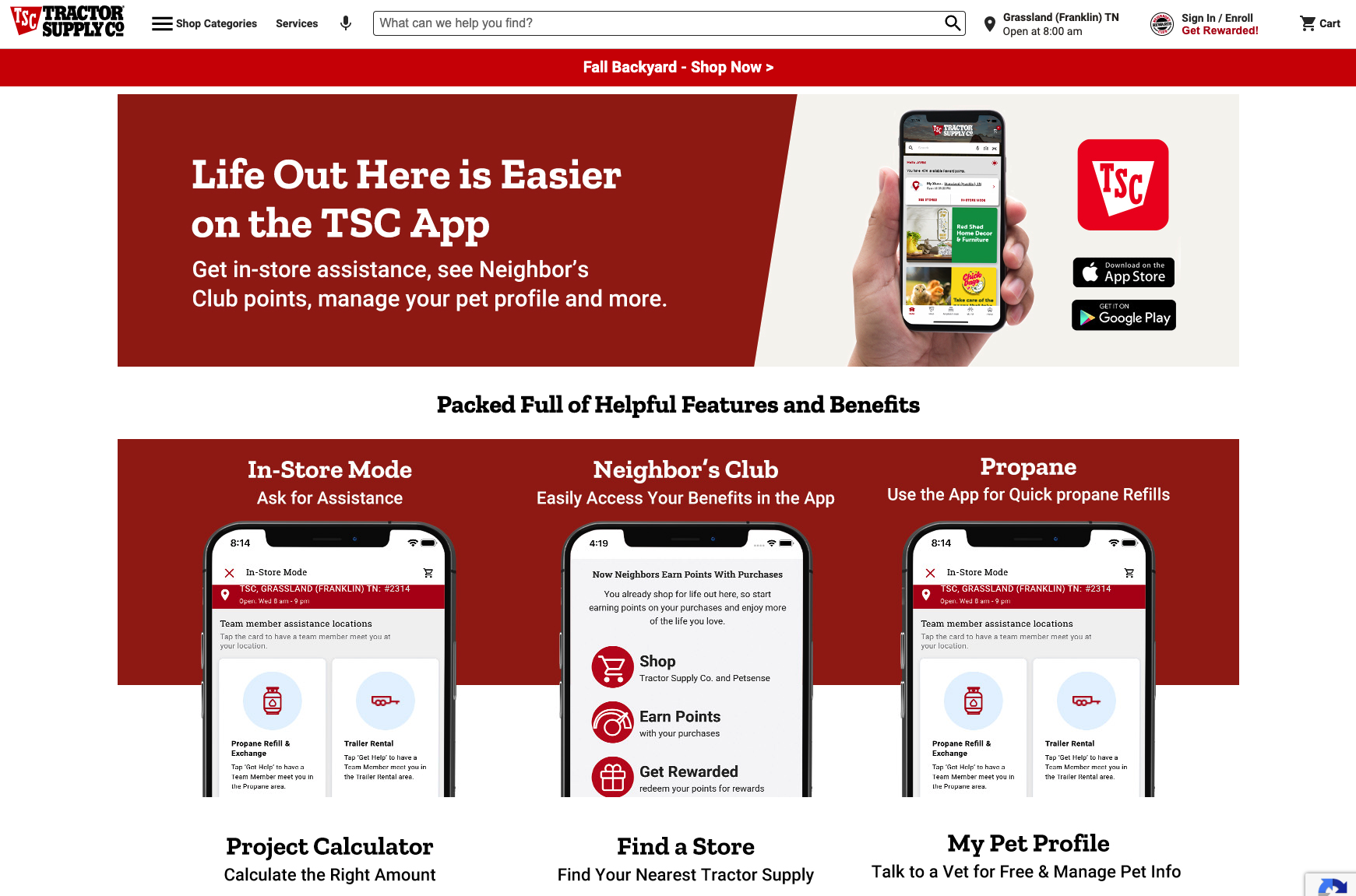

In 2020, I consulted with Tractor Supply Company, a major retail chain with over 1,900 stores, on enhancing their mobile application. This project presented a different kind of institutional challenge—balancing innovation with the practical realities of a large-scale retail operation where technology needed to support both e-commerce and in-store experiences across diverse geographic locations and customer segments. I focused on improving app performance and code quality while developing an augmented reality feature for product previews that allowed customers to visualize items in their actual environment before purchase.

What distinguished this institutional experience was navigating the complex integration requirements between the mobile application, inventory systems, and in-store operations. I implemented TypeScript for improved maintainability and scalability, ensuring the codebase would remain robust as the company expanded both physically and digitally. The project required close collaboration with product merchandising teams and store operations staff to ensure that technical features aligned with the company's broader retail strategy. This experience reinforced my understanding that successful institutional engineering requires situating technology within the organization's complete operational context—creating solutions that complement existing business processes while introducing new capabilities that drive growth and customer satisfaction.

Institutional Projects

Latest Institutional Articles

Let's Work Together

I typically work through remote 1099 contracts via my US-based company, Blockmatic Labs LLC. This setup gives clients straightforward contracts, built-in compliance, and IP protection. Based in Costa Rica, I operate on US Mountain Time and am just a short flight from major US cities.

If you’re exploring something ambitious—a decentralized system, an AI-powered product, or an idea that needs a strong technical foundation—I’d be happy to hear from you.