I've worked with US teams for years as a senior product-minded engineer—shipping web, AI, and Web3 products end-to-end. Along the way I've tried every payment and engagement model you can imagine: direct invoices from abroad, employer-of-record setups, hybrid retainers, and even pseudo-payroll arrangements. After a lot of trial, error, and paperwork, one model has been consistently better for both sides: operating as a 1099 contractor through my Delaware LLC, Blockmatic Labs LLC.

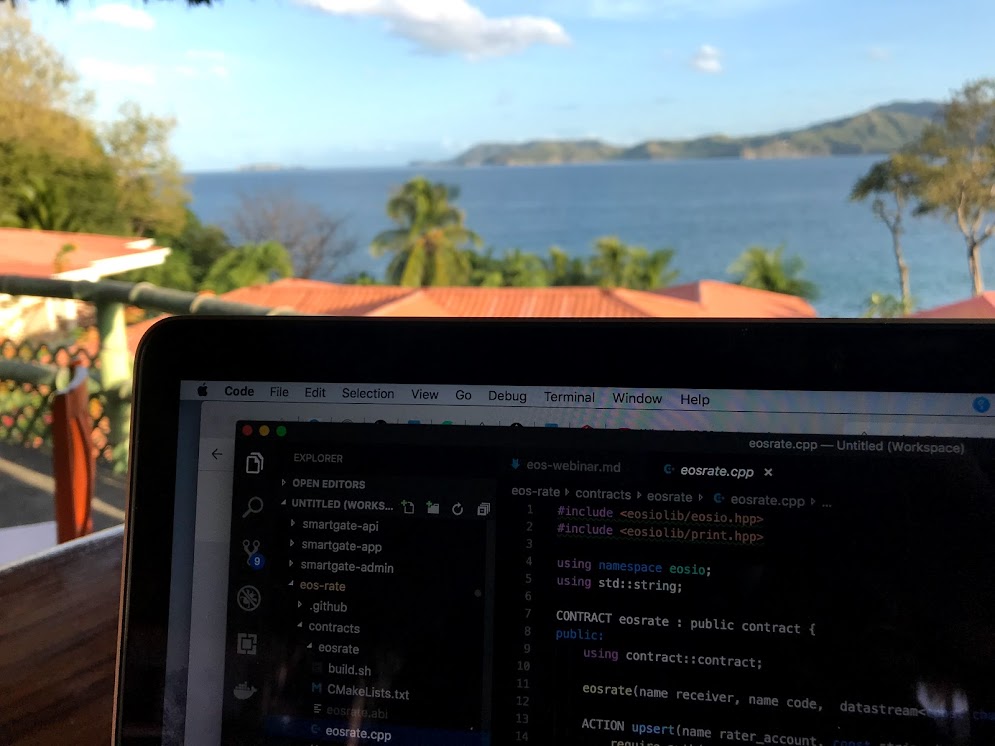

I'm based in Costa Rica, aligned with US Mountain Time, and close enough for quick trips to major US cities. I typically work with one client at a time, often in a full-time capacity through a perpetual contract—open-ended, without a fixed termination date. These long-term engagements are usually with startups in Web3 or AI. Depending on the project, I often negotiate some form of equity or token allocation to align incentives and reward outcomes.

This model works well beyond the US. I've used it to contract with companies in Germany, Korea, Singapore, and other markets. Delaware entities are globally recognized, and this setup has helped me work with teams across the world while keeping compliance clear and operations smooth.

Why 1099 Over Payroll

- Global work, less friction. W-2 payroll isn’t designed for non-US residents working remotely. 1099 is standard.

- Speed and scope. Easy start, flexible engagement, outcome-focused.

- Procurement-ready. Most companies already support LLC vendors.

- Separation of concerns. My LLC handles ops; clients focus on product.

US-Side Setup

Not legal/tax advice. Every case is different; talk to a professional before copying my setup.

Stripe Atlas handles LLC formation, EIN, and templates. Mercury provides a clean USD account, cards, and statements. OpenPhone gives me a US number for client comms and verifications. QuickBooks tracks invoices, categories, and reports. onlinetaxman.com ensures compliance for non-resident LLCs with annual filings.

Rule of thumb: I'm not a US person, I perform the work outside the US, and I don't sell into the US. That means the revenue is treated as foreign-sourced (services are sourced where they're performed), so no US income tax applies to it. I still complete the paperwork payors and banks need—W-8BEN/W-8BEN-E as applicable and, for the LLC, the annual Form 5472 + pro-forma 1120 via onlinetaxman.com, plus any 1042-S I'm issued—so records stay clean. Your facts may differ—confirm with a professional.

Costa Rica Compliance

- Hacienda (Tax Authority): Registered as independiente. Even with "0" income locally, registration helps with bank KYC, credit, and legitimacy.

- Caja (Social Security): Also registered as independiente—mandatory.

- Private health insurance: Caja is strong for serious care, but slow for consults. Private coverage gives same-day access.

When banks ask for source of funds, the Compliance Packet Checklist below is usually sufficient.

Money Flow (End to End)

- Sign MSA/SOW as Blockmatic Labs LLC (1099 contractor)

- Invoice via QuickBooks in USD (bi-weekly/monthly)

- Client pays into Mercury

- Wire to Costa Rica as needed, keep books clean

- File US forms annually via onlinetaxman.com

- Report income in Costa Rica and stay current with Caja

This setup enables USD pricing and clean invoicing, vendor trust and compliance clarity, and outcome-oriented engagements. The structure removes friction from procurement, keeps books clean, and lets both sides focus on results rather than payroll overhead.

Additional Tools

Common Questions

Can a US company hire me as 1099 if I live in Costa Rica? Yes—through your US LLC. This is standard.

Do I need to be in the US to use Mercury or Stripe Atlas? No. You'll need to pass KYC and submit proper docs.

Will Costa Rican banks accept USD wires from my LLC? Yes, but they’ll ask for proof of source. Keep your compliance packet ready.

What about taxes? I file annually in the US (via onlinetaxman.com) and meet all local obligations (Hacienda + Caja). QuickBooks keeps everything reconciled.

Compliance Packet Checklist

When banks or clients need proof of legitimacy, I keep ready:

- LLC formation docs + EIN

- Contracts/SOWs

- QuickBooks invoices

- Mercury statements (3–6 months)

- Proof of Hacienda & Caja registration

- Private health plan (optional)

Running 1099 through a US LLC has been the cleanest, most scalable way for me (from Costa Rica) to work with US clients: fast onboarding, USD invoicing, clear compliance—without the fiction of payroll. If you're outside the US and want to work with US clients, this model may work for you.

If you're a company that prefers incorporated vendors—or want to compare setups—feel free to reach out.